12 August 2022

Make decisions today to save the constraints of tomorrow

Thought piece from ecube CEO - Lee McConnellogue

Many of us throughout aviation wrestle with data. Be it historic, predictive, or live data, we put a lot of trust into these sources, but often it is just data and not first-hand information.

I would like to acknowledge the great article recently written by Yuri Tokarev – 'The Cursed 4000', it is thought provoking, very timely and the inspiration for this piece.

The article does a great job of pulling together the key strands for the industry, passenger number recovery, OEM deliveries, technical issues resolved and cargo conversions, but it concludes much as it started, with a Cursed Four Thousand.

I can relate to this, I attended AFRA’s Annual conference in June where lessors, parts companies, and analysts all acknowledged that at the previous conference in 2021, all had predicted a bow wave in retirements and disassembly’s that [as of Q3 2022] has not come…yet.

Why wouldn’t they have predicted that!

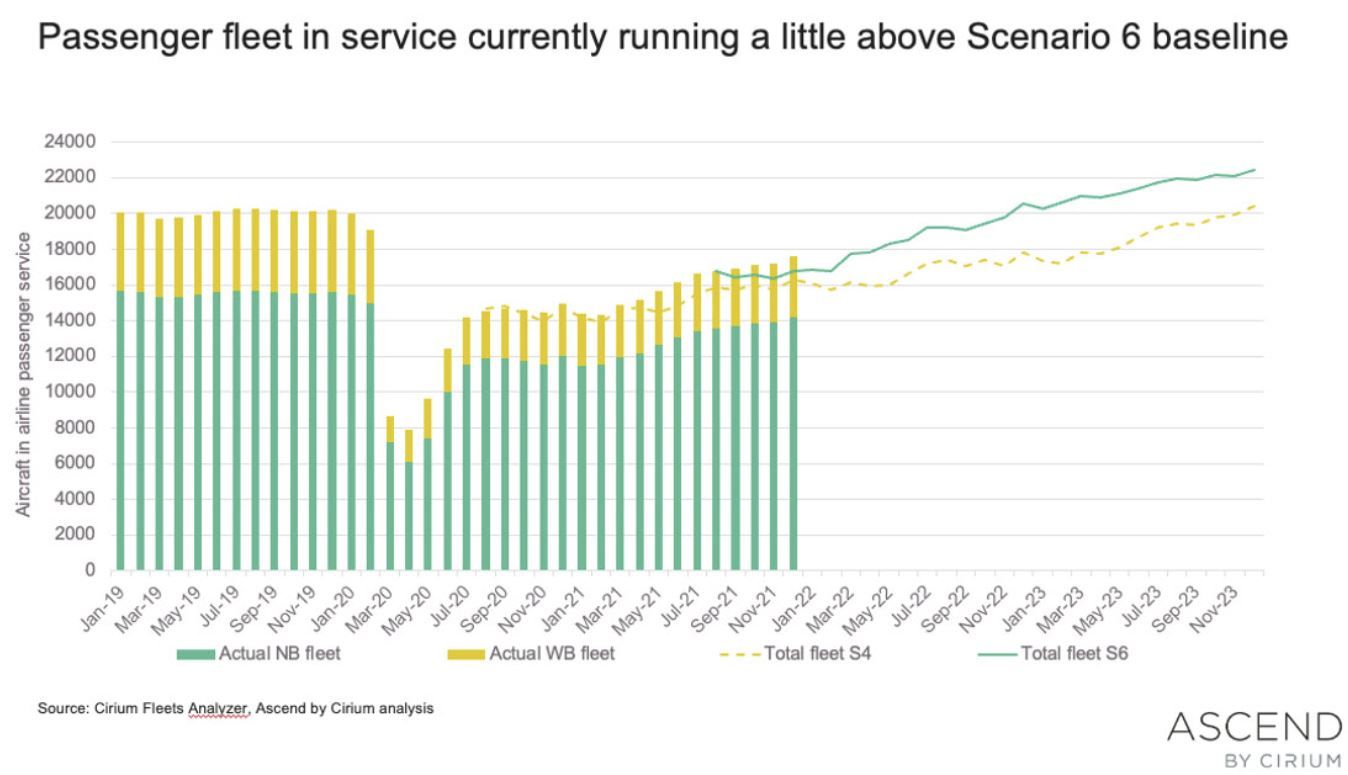

If we wind the clock back to April 2020, in response to IATA’s prediction of a 48% fall in traffic, Cirium’s Thought Cloud stated that aircraft retirements in 2020/21 could potentially reduce surplus jets during traffic growth recovery post the outbreak of COVID-19.

An assumption based on solid data led principles. At the time, no one was shouting "it will not happen".

Back in February however, Cirium’s George Dimitroff highlighted a trend, saying: “At the moment, there is not enough money in retiring an aircraft – with the exception of some types which share parts with the cargo version of themselves. We have seen Boeing 747, 757 and 767 product values increase for this reason.”

Where we are today.

It is clear that the lessor community have been flexible over the last three years, giving airlines terms that allowed them to keep assets at extremely attractive rates whilst weathering the storm.

Furthermore, it is also clear that for some types, it is all about the rise of the freighter conversion, as predicted by George, notably the B737-800 and the A321 – with 45% of the total number of conversions for these aircraft over the past four years coming in 2022. Source: Cirium.

The bow-wave of retirements however continues to be pushed to the right, with 2022 Q4, 2023/24 all being mentioned across the industry.

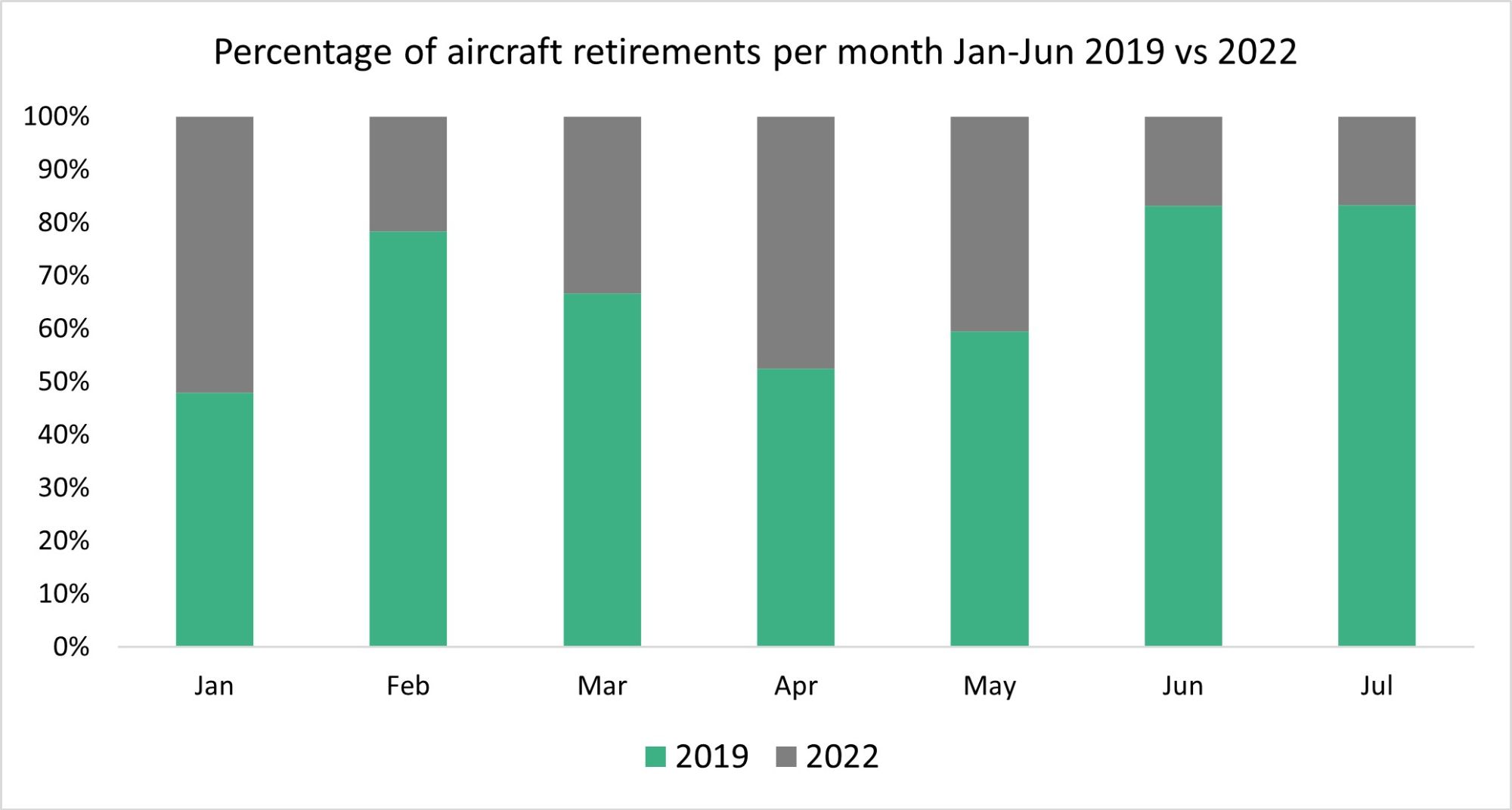

When comparing January-July 2019 to the same period in 2022, there has been a 51.9% reduction in aircraft retirements [Cirium], so the question is, will this wave begin to form, or will we see the past repeat itself and end up with more aircraft than ever before left stranded in the desert?

But why are we here?

Is it a hangover from the pandemic?

Covid saw many of these assets repositioned to airfields that could not handle large numbers of returns to service largely due a lack of available skilled resource – The same challenge that is hitting every part of aviation now.

Is there a reality gap?

Are we actually in a period where asset book value is the key constraint? Values may have put some assets beyond the reach of parts companies and resulted in them being stored in deserts across the world.

The global economy?

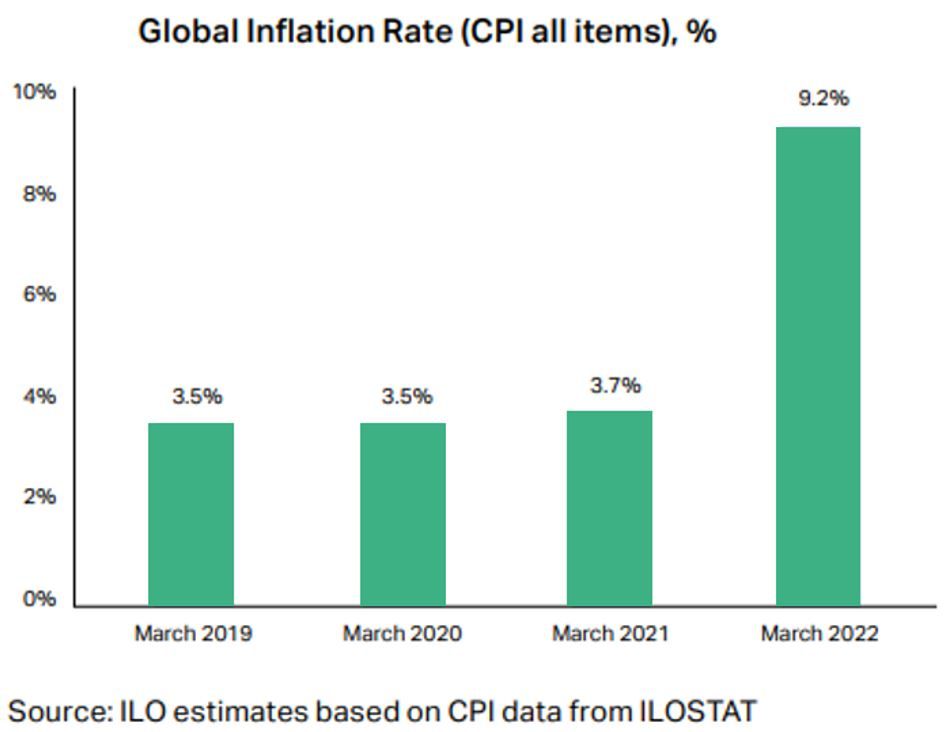

The global inflation rate is certainly having an impact at consumer level with purchasing power being reduced, thus impacting economic growth within aviation and beyond. As a result, we must consider that this is making us all hesitant with the impending recession.

So, what is next?

In the end we must keep talking to understand each individual scenario and see where the trends take us. The variables are not quite infinitesimal but not far off.

Within the industry we must be brave. The risk is that we hesitate for too long, leading to decisions that could be accommodated today being left to build up the constraint of tomorrow. Further reinforcing the thesis behind the Cursed 4000 and industry labelled ‘Zombie Fleet’.

Aircraft destined for retirement possess more than just monetary value. They present an opportunity to lead in the ESG and circular economy space - reuse more to source less.

REFERENCES:

1. Rob Morris: COVID-19 continues to drive a stress scenario beyond what we imagined – Cirium