25 February 2025

In Case You Missed It (ICYMI)

The use of AI in maintenance scheduling and the importance of sustainability in end-of-life processes have featured in the press recently. In case you missed it, here are a few articles we’ve been reading.

25 Feb 2025

Tariffs

Both Cirium and FlyingMag take a look at potential American tariffs. Aviation will, of course, be impacted by this in terms of costs and supply chain lead times. However, it might also increase the industries use of recycled components and materials.

We expect the tariffs discussion to mostly impact freight and OEMs initially. Cirium also says that tariffs will have a ‘more substantial impact on the air cargo sector due to their broader scope’.

But there may be a knock on effect for the end-of-life sector. If the supply chain becomes more expensive, manufacturers may look elsewhere to source their materials. This may also cause it to become more complicated as these materials have to be shipped from different locations.

This could have an impact on the disassembly market. Its early days, but restrictions in the supply chain could cause demand for components and aircraft. We will be watching to see if this brings more aircraft to the phase out stage, as airlines and lessors look to support their flying fleets with reuse parts, rather than new ones.

As Phillip Gulley says in Flying magazine, “Things are super in flux right now”. (Chief strategy officer and co-founder of the supply chain execution platform Cofactr).

References:

Deliveries

Cirium has data on deliveries from last year: down for both Boeing and Airbus. For mainline commercial aircraft types it was down over 10% year on year. That said, Cirium is projecting deliveries for 2025 will reach the 1,500-mark originally expected last year.

In 2024 Airbus delivered 766 aircraft and Boeing 333. Airbus was down from the expected 800, due to supply chain issues. Boeing was a third down on its 2023 deliveries, owing to the repercussions of the Alaska 737 Max accident and other issues.

That said, in January 2025 Boeing delivered 44 jets, according to AirInsight data. This is nearly double its 25 deliveries from January 2024 and puts Boeing at one-tenth of its delivery goal for 2025.

For 2025, Cirium suggests ‘Airbus could see its deliveries rise by up to 15% or more, while Boeing is expected to recover its shipments volume and move back towards a share of around 40%. But much will depend on supply-chain and regulatory progress this year’.

References:

https://www.cirium.com/thoughtcloud/shaking-out-the-airbus-and-boeing-2024-delivery-numbers/

Freight

IATA noted strong growth in the air cargo sector of our industry. A 9.5% increase year-on-year in November 2024 is largely attributed to rising ecommerce demand in the US and Europe, they conclude.

This strong growth is tempered by some potential downsides however. IATA recommends carefully watching areas like the Purchasing Managers Index (PMI) for global manufacturing output. A drop here could indicate ongoing uncertainty in global trade. In addition, inflation is rising in the USA and the EU, which may weaken consumer spending.

It’s possible a slowdown could lead to a need for freighter plane storage as owners look to ride out any softening in the market. A pause to see what happens next.

References:

https://www.iata.org/en/pressroom/2025-releases/2025-01-09-01/

20 Jan 2025

Aviation Week - GE Aerospace Develops AI Maintenance Records Tool That Uses AI.

Over at GE Aerospace, they’ve developed a new tool that will allow airlines and lessors to access critical maintenance records faster. It could reduce hours of search work down to minutes.

It’s interesting to see how our industry is finding uses for generative AI technology. The team at GE Aerospace comment that ““We see this capability as enabling a fundamentally different way of interacting with technical records and data, enabling customers to identify and interact with documentation without manual document indexing processes.”

We’re always interested in new technologies that improve the maintenance schedules of aircraft, so we’ll be watching with interest.

GE Aerospace Develops AI Maintenance Records Tool | Aviation Week Network

Aviation Week - Improving MRO Sustainability Through Part Shipment Reductions

Procurement is not always an area we look to for new technology, but SkySelect sees improvements in procurement technology that can help airlines to reduce shipments by as much as 30% and maintain fewer parts in stock. This has environmental benefits as well as financial ones; it not only minimises logistics costs, but reduces carbon emissions.

Logistics management is a key focus for ecube too. Our specialist logistics team apply space-optimising software to our deliveries to ensure our customers get the most effective, and cost-efficient, delivery system.

MRO Memo: Demand Endures For Older Engines | Aviation Week Network

The Economist reported on the last flight of an Air India 747-400.

The aircraft dipped its wings and began its end-of-life journey in the desert. It doesn’t tell us in the industry much that we don’t already know, but it’s interesting to see this esteemed publication taking a look at how to bring value to old assets.

How retired aircraft find a second act | The Economist

05 Dec 2024

Aviation industry to add 45,900 aircraft worth $3.3 trillion over the next 20 years

Interesting news from Cirium’s forecast team; the aviation industry will bring onboard 45,900 aircraft worth $3.3 trillion over the next 20 years. These are likely to be passenger, freighter and turboprop aircraft, with 98% being passenger aircraft, led by a projected 3.9% annual growth rate for single-aisle aircraft.

It also suggests that the number of active aircraft globally now exceeds pre-pandemic levels. In Q4 this year, ‘a total of 26,100 aircraft are currently in service, which is up 5% on January 2020’.

But, Cirium’s short-term forecast to 2027 predicts a 5% drop in deliveries due to supply chain issues. This seems to be a shortage in components. These may not all be brand new aircraft either. Cirium predicts that the majority (it says 70%) will be passenger-to-freighter conversions.

This means there’s still pressure for parts and the value of aircraft, especially those reaching retirement is going up. Keeping aircraft flying looks like a continuing trend for 2025.

Aviation industry to add 45,900 aircraft worth $3.3 trillion over the next 20 years – Cirium

18 Oct 2024

Widebody Orders Continue to Grow

Cirium has noted that Airbus A330neo orders are up: ‘57 new firm orders and 60 options from four customers’. It also says that ‘particularly striking [are the] new firm orders for 20 aircraft from VietJet Air and 30 from Cathay Pacific’.

In our April newsletter we predicted widebody orders could well run into the hundreds this year. We think demand is driven two things; the age of many widebodies and a sustained increase in passenger numbers. A driver for Cathay Pacific must be to scale up capacity.

It also looks like a quicker delivery time than Boeing is a key factor. Delivery for A330neo is estimated as early as 2028, given a delivery rate of four per month. According to Cirium’s Tim Chun-Hing Li, ‘primary drivers for Cathay to opt for the A330neo were the smaller backlog and more-favourable mix of operating and ownership costs and payload-range performance’,

The A330neo: Is Airbus’s Middle Child Fighting Back? – Cirium

How will AI work for aircraft maintenance planning?

There’s a good overview of the uses of AI in Aviation Week by Keith Mwanalushi.

Mwanalushi looks at AI in simulation tools, to maximise maintenance yield and for predictive maintenance. AI can help to ‘examine [the] issues, identify the most likely scenarios and make better business-critical decisions’ he reports.

Take a look at our full article on LinkedIn

02 Sept 2024

What’s the Potential for Aircraft and the Circular Economy?

Aviation Business News recently included our CEO, Lee McConnellogue in a piece on the importance of following the AFRA best practices. (The Aircraft Fleet Recycling Association’s accreditation system).

The association’s president, Brent Webb, says:

“The guidelines include detailed instructions for managing materials recovered from aircraft at the end of their useful life”.

By doing this we can maximise resource recovery and reduce the environmental impact of our industry.

Reusing components gives airlines a way round the pressures of the supply chain. They can also cost up to 40% less than new parts. This doesn’t have to be a slow process. On average, we can disassemble an aircraft in three to five weeks. We were 24% up on components removed in the first half of 2024, compared to the same period of 2023, and we’re looking forward to an equally busy second half of the year too!

Prime Minister Highlights Industry Skills in Farnborough Speech

Keir Starmer was also at Farnborough, taking to apprentices at Airbus and Rolls Royce. He described the young people as “an incredible reminder of the talent that we have” in the industry. They told him they wanted the new government to ‘think about the value of apprentices’.

Just before Farnborough, our CEO, Lee McConnellogue had also raised the issues of skilled worker shortage in the aviation industry. Lee talks about his own experience as an apprentice at Britannia Airways. He also looks at how an industry that is used to long-term planning can refocus on training.

The full piece is on our website - How Can We Tackle The Skilled Worker Shortage In The Industry? (ecube.aero)

Starmer’s speech at Farnborough - PM's remarks at the Farnborough Airshow: 22 July 2024 - GOV.UK (www.gov.uk)

More certainty and a steady market discussed at ISTAT Hub and Reception Farnborough this year.

And could we possibly see the beginning of the bow wave?

Or has the bow wave of retirements begun? This was pushed out in the years immediately post-Covid. The theme of ISTAT 2023 was lift at any price. Passenger demand was high, and aircraft were needed in the sky. Retirements were pushed out.

We may now be seeing the first signs of a breaking bow wave. At ISTAT Americas 2024 in July, we fielded more enquires about disassemblies than last year. There is more certainty about getting older aircraft out to make way for those coming on stream.

There was also more confidence about deliveries too. There didn’t seem to be many orders being placed for new aircraft, but the industry has now normalised the extended arrival dates. Longer timelines have been factored in. This may be easier to accept as passenger numbers slow up.

The passenger demand trend continues to ease. Growth is at about 1% as spend per head drops, leading to lower revenue per seat. The market is returning to a greater balance between demand and price pressure. We saw this in an uptick in discussions about active storage and transition, especially livery changes. Elsewhere in the industry there have been forecast warnings from airlines in the USA, Europe and the UK.

So, perhaps gently, the brakes have gone on. These trends have been ticking up for a few months, but we noticed at ISTAT that the slowing pace meant more conversations about our core services. Not just disassemblies, but storage, maintenance and transition.

We saw these trends crystalise at ISTAT. There’s more confidence in deliveries, a steadying of passenger numbers, and perhaps the bow wave of retirements beginning to break. We think that this certainty will continue throughout 2024 and into next year.

15 July 2024

Is the pilot shortage easing?

Contrasting news on the skills shortage in the aviation industry. Flying magazine reports that US airlines are slowing up on pilot hiring. There are signs that recruitment is meeting demand, but also that the delays in the Boeing pipeline mean fewer pilots are needed.

American Becomes Latest Airline to Halt Pilot Hiring - FLYING Magazine

Mechanics are still in short supply

In other Flying news it seems that the shortage of aviation mechanics is showing no signs of being alleviated. It cites Boeing, who suggest that the global industry needs to recruit and train 610,000 new maintenance technicians by 2041.

The Aviation Mechanic Shortage Is Worse Than You Might Think - FLYING Magazine

We take a look at what you can do to manage this generation gap in our blog on:

How Can Aviation Bridge the Skills Gap?

04 June 2024

Latest research* predicts a rise in the global commercial aircraft disassembly market.

The global market is estimated at US$6.4 Billion in the year 2023 and is projected to reach a revised size of US$9.7 Billion by 2030. This is a CAGR of 5.3% over the analysis period 2023-2030.

Narrow Body is expected to record 5.6% CAGR and reach US$6.6 Billion Wide-Body is estimated at 4.9% CAGR for the next 8-year period.

The U.S. Market is Estimated at $1.9 Billion, While China is Forecast to Grow at 4.8% CAGR

Within Europe, Germany is forecast to grow at approximately 4.3% CAGR.

Encouraging news as it’s a slightly shorter timeframe than the KMPG Report we cited in the last newsletter, although the CAGR is not as high. KPMG said: ‘The global commercial aircraft disassembling, dismantling, and recycling market is projected to grow to over USD14 billion by 2032, a CAGR of almost 8%’.

Aviation in Europe is showing some capacity softening.

Routes Online has reported numbers which show a softening from the post-Covid travel of the last year or so in Europe. Based on schedules filled by airlines, capacity recovery in Europe fell in the first quarter of this year. This report suggests that the improving trend of Europe RPKs as a percentage of 2019 volumes may be flattening off.

The question is whether this will indicate a similar trend for traffic. Is traffic now returning to being mainly GDP-driven?

Some key stats:

Official inflation data for the EU shows that the price of passenger air travel grew by just 2.5% year-on-year in Dec-2023.

The UK's air transport inflation was only 0.8% in Dec-2023, after falling from a peak of 44.1% in the 12 months earlier.

In 2019 international seats accounted for 75.7% of all capacity in Europe, whereas this grew to 77.0% in 2023.International capacity is much more important than domestic capacity in the European market.

Is the uptick in post-covid travel levelling out?

The Financial Times is reporting ‘normalised demand’ in US travel as post-pandemic travel eases off. This seems to be in leisure travel, rather than business. Southwest Airlines’ RASM was at the low end of the forecast for Q1.

However, the US Travel Association expects and uptick of 7% in business travellers taking domestic trips. It compares this to a likely 1.9% for leisure travellers.

The FT expects this gap to continue. It cites Delta Air Lines and Hilton Worldwide as two companies with international reach catering to business travellers. Both have ‘outperformed their group peers’ in the last year.

Are part-outs up or down in 2024?

We’re servicing a bigger mix of aircraft than ever before with disassemblies at ecube expected to be up by the end of the year.

We’re doing more and we’re doing it differently.

We talk about disassembly, where other companies offer ‘teardown’. Our aim is to reverse manufacture an aircraft, so that as many precision parts as possible can be returned to the flying fleet. We discuss this in our blog When Parts Are At A Premium Here’s Why Disassembly Is More Than Just Teardown

In contrast to recent comments in Aviation Week, we’re seeing more part-outs to support the flying fleet. We’re enabling airlines and lessors to keep their aircraft in the air for longer, because we can renew them with precision parts. This helps aircraft to come out of storage and be transitioned back into the fleet.

19 April 2024

The Potential For Aircraft And The Circular Economy

KPMG says the circular economy in aviation is ‘a concept whose time has come’. In its report on Circularly in Flight, published in March, it looks at:

- How airlines can achieve their ESG goals

- The expected size of the market in the next decade

- The rate of retiring aircraft by 2038

- The need for industry collaboration to effect meaningful change.

We give our own analysis on these ideas here and the full report can be downloaded from their website here https://kpmg.com/ie/en/home/insights/2024/03/circularity-in-flight-fs-aviation.html

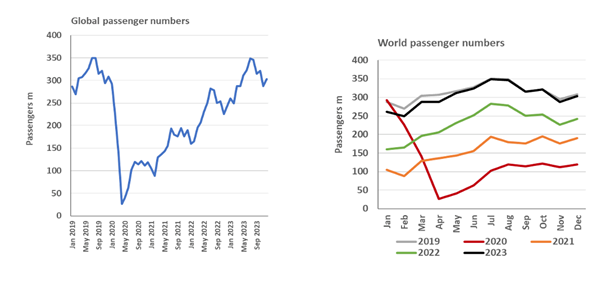

Passenger Numbers Up, But Can Airlines Keep Pace?

Cirium released its latest research in March. It shows the rise in passenger numbers, but Kevin O’Toole (Chief Strategy Officer) also asks an important question about whether airlines can respond while supply remains slow?

‘The ongoing recovery in Asia should help to keep world traffic moving upwards through 2024. The bigger question is perhaps whether airlines will be able to keep supply and demand in balance, especially as the input costs continue to rise. Going in to 2024, analysis of the Cirium forward-looking schedule suggests that capacity growth remains modest at around 4% for the year and likely to run a point or two behind demand, as it has during 2023.’

How Will The P&W Issues Affect The Industry?

Our CEO, Lee McConnellogue takes a look at the issues at Pratt & Whitney. Does its affect on the industry depend on where you sit? Do grounded aircraft tend to be more of an issue for airlines that rely on market share?

You can read Lee’s thoughts here: How Will The P&W Issues Affect The Industry? | LinkedIn

There’s also more on this issue in Aviation Week.